Welcome to the world of eInvoice! The digital Invoicing is becoming increasingly important in today's world. By switching to electronic invoices not only save considerable costs, but also improve their Invoice processes more efficiently. With our innovative Invoice management-solutions, we make the introduction of the eInvoice is child's play for you.

With the DATUREX GmbH we are experts for digital invoices and offer customized Invoice processing-systems. Our Invoice software allows you to seamlessly access Online invoices and benefit from the advantages of the eInvoice to profit. No matter whether e-billing or Automated invoicing processes - We will find the perfect solution for your company.

Key findings

- The Electronic invoicing will be mandatory for companies from 2025.

- With the eInvoice you save costs and increase the efficiency of your Invoice processes.

- The DATUREX GmbH offers innovative Invoice management-solutions for the Digital invoicing.

- Our Invoice software supports you with the changeover to Online invoices.

- Benefit from the advantages of eInvoice with our customized Invoice processing-systems.

Legal basis of the eInvoice

The introduction of the eInvoice in Germany is based on various legal requirements at European and national level. These regulations form the foundation for the Electronic invoicing and the associated requirements.

EU Directive 2014/55/EU

At European level, the EU Directive 2014/55/EU sets the standards for the Electronic invoicing in public procurement. The aim of this directive is to facilitate the cross-border exchange of electronic invoices within the EU and to harmonize them.

E-bill regulation in Germany

In Germany, the EU Directive was implemented by the E-Invoicing Ordinance (E-RechV) of October 13, 2017. This ordinance regulates the requirements for Electronic invoicing in dealings with public-sector clients and sets standards for the use of the eInvoice fixed.

Value Added Tax Act (UstG)

In addition, the German Value Added Tax Act (UstG) defines the tax requirements for electronic invoices. Among other things, it defines the criteria that must be met for an invoice to be considered valid. eInvoice is recognized.

Principles of proper accounting (GoBD)

Furthermore, the principles of proper accounting (GoBD) also apply to the Invoice processing and Archiving from electronic invoices. The GoBD ensure that the legal requirements for bookkeeping, storage and documentation of records are met.

| Legal basis | Area of application |

|---|---|

| EU Directive 2014/55/EU | Standards for Electronic invoicing in public procurement within the EU |

| E-Invoicing Ordinance (E-RechV) | Implementation of the EU directive in Germany, regulations for the use of the eInvoice in dealings with public clients |

| Value Added Tax Act (UstG) | Tax requirements for electronic invoices |

| Principles of proper accounting (GoBD) | Requirements for the Invoice processing and archiving of electronic invoices |

This legal foundation creates the basis for the Digitization of invoicing processes and the introduction of the eInvoice in Germany. Companies must comply with these requirements in order to Electronic invoicing legally compliant implementation and Automated invoicing processes to implement.

Definition and requirements of an eInvoice

According to the German Value Added Tax Act (UStG), there are specific requirements for a digital invoice as a proper eInvoice is recognized. These requirements serve to ensure the authenticity and integrity of the electronic invoicing and to ensure that the invoice management-processes are legally compliant and efficient.

Electronic creation and dispatch

First of all, a eInvoice be created electronically from scratch and transmitted digitally to the invoice recipient. A merely scanned paper invoice does not fulfill this requirement, as it is not originally created as an invoice. digital invoice was designed.

Readability for people

Furthermore, a eInvoice be human-readable. This means that all relevant information such as invoice amount, service description and payment information must be presented in an easily understandable format, for example as a PDF document or in the ZUGFeRD standard.

Authenticity of origin

To verify the authenticity of the origin of a eInvoice companies must implement internal control procedures. This can be done, for example, by using qualified electronic signatures or by using secure transmission channels.

Integrity of the data

After all, the integrity of the data stored in a eInvoice data must be guaranteed. For this purpose, procedures such as the calculation of a checksum are often used to ensure that the invoice data has not been manipulated during transmission and storage.

Companies that meet these requirements can benefit from the advantages of the invoice digitization such as cost savings, increased efficiency and improved traceability. The use of a professional invoicing software can provide valuable support here.

Standards for eInvoices in Germany

In order to ensure conformity with the generally accepted accounting principles (GoBD) for the electronic invoice processing companies and governments in Germany have worked together to find solutions. As a result of the e-invoicing regulation, two main standards have been established: the XInvoice and ZUGFeRD.

XInvoice

The XInvoice is an XML-based data model that was developed specifically for the Invoice exchange between authorities and governments at European level. This standard enables a smooth Electronic invoicing and -processing within the public sector.

ZUGFeRD

ZUGFeRD on the other hand, is a standard for hybrid invoice data. It combines the advantages of PDF files with machine-readable XML data, whereby online invoices for both humans and automated systems Invoice processes are readable. ZUGFeRD facilitates the Electronic invoicing in the B2B sector and is used by many companies in Germany.

Both standards have proven to be efficient solutions for Invoice processing and are helping to facilitate the transition to mandatory electronic invoicing in Germany.

| Standard | Area of application | Format |

|---|---|---|

| XInvoice | Authorities and governments (public sector) | XML |

| ZUGFeRD | B2B area (companies) | PDF with embedded XML |

eInvoicing in the B2B sector

The federal government plans to Electronic invoicing between private companies as quickly as possible. Currently, companies in Germany with a E-billing obligation for the B2B area from January 1, 2025.

Planned introduction of mandatory e-invoicing from 2025

The planned introduction of the E-billing obligation for the B2B sector from 2025 represents a major challenge for many companies. The Electronic invoicing requires not only technical adjustments, but also a reorganization of internal processes and procedures.

"The digitalization of invoicing processes is an important step towards efficiency and sustainability. Companies that prepare for the changeover at an early stage can benefit from the advantages." - Dr. Matthias Bauer, expert for digital Invoice processing

In order to legal requirements to fulfill these requirements, companies must invoice management-solutions, which can Electronic invoice processing and online invoices support.

The following table shows the most important steps for preparing for the e-invoicing obligation:

| Step | Description |

|---|---|

| 1. process analysis | Analysis of existing invoicing processes and identification of optimization potential |

| 2. software evaluation | Selection of a suitable Invoice softwarethat meet the requirements for digital invoices fulfilled |

| 3. employee training | Training of employees for the use of the new Invoice software and the digital processes |

| 4th test phase | Carrying out a test phase to identify and rectify potential problems |

| 5. implementation | Complete changeover to the Electronic invoicing by January 1, 2025 at the latest |

Advantages of the eInvoice

The changeover to Electronic invoicing with digital invoices offers companies numerous advantages. Through the Invoice digitization not only saves costs, but also saves time and space. In addition, the Automated invoicing processes efficiency considerably.

Cost savings

Paper invoices cause high costs for paper, printing and postage year after year. With the eInvoice eliminates these expenses completely, allowing companies to save money.

Space saving

Since electronic invoices are archived digitally, they no longer require physical storage space. This Invoice digitization creates valuable space in offices and warehouses.

Time saving

By eliminating manual tasks such as printing, enveloping and mailing, you save time and money. Automated invoicing processes a lot of time. Digital invoices are created and transmitted electronically.

Increased efficiency

The Electronic invoicing optimizes the entire invoice process - from creation and transmission to archiving. Manual sources of error are eliminated, processes become leaner and more efficient.

| Advantage | Description |

|---|---|

| Cost savings | No expenses for paper, printing and postage |

| Space saving | Digital archiving instead of physical storage space |

| Time saving | Automated processes without manual activities |

| Increased efficiency | Optimized invoicing processes without sources of error |

Practical example: Invoicing with ZUGFeRD

As an illustrative example of the Electronic invoicing Let us consider a carpenter who has made a table for a customer. For this work, the carpenter now provides a Invoice in the amount of € 1,000. In order to save paper and digitize the invoicing process, the carpenter decides to send the customer a ZUGFeRD invoice by e-mail.

What is special about the ZUGFeRD-variant of a eInvoice is that, on the one hand, it contains all the necessary information like a conventional paper invoice and can therefore be read by humans. On the other hand, it also fulfills the legal requirements for a Electronic invoicingprovided the customer has given their consent in advance. With ZUGFeRD you can therefore Invoices in an uncomplicated way online send and process.

The Invoice management is considerably simplified and made more efficient for companies through the use of standards such as ZUGFeRD. The digitization of Invoicing offers numerous advantages, such as cost, space and time savings as well as greater process efficiency compared to paper-based invoices.

Legal aspects of the changeover

When switching to eInvoice there are a few legal aspects to consider. Firstly, the invoice recipient must consent to electronic invoicing. However, consent is deemed to have been given retroactively if the recipient does not object. In addition, companies must internal control procedures to establish the authenticity and integrity of the digital invoices guarantee.

Consent of the invoice recipient

In accordance with the statutory provisions, invoice recipients must explicitly consent to electronic invoicing. Consent given can be revoked at any time. However, consent is deemed to have been granted retroactively if the invoice recipient does not object after receiving the first electronic invoice.

Internal control procedures

To ensure the authenticity of the origin and the integrity of the data of eInvoices companies are obliged to ensure that suitable internal control procedures to be introduced. This includes, for example, the use of qualified electronic signatures or the implementation of Invoice software with appropriate safety measures. This is the only way to ensure compliance with the legal requirements for proper Invoice processing and Invoice digitization guarantee.

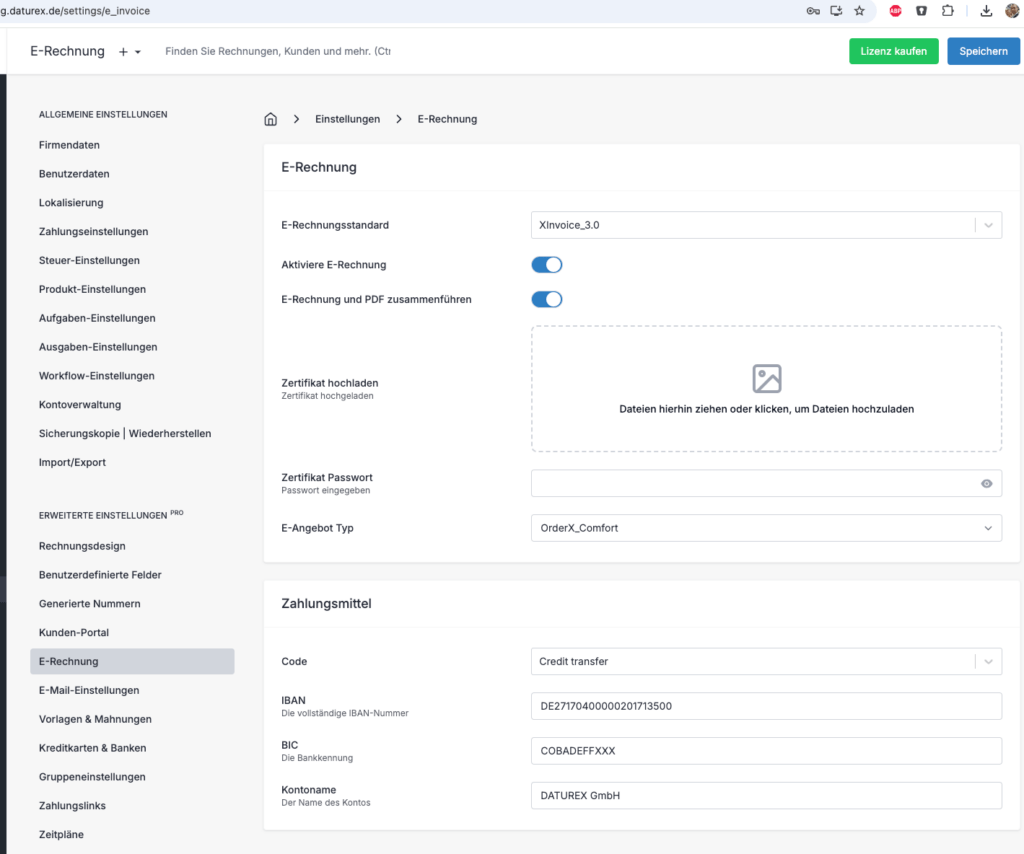

eRechnung and DATUREX GmbH

As a leading company in the field of digital invoicing, the DATUREX GmbH innovative eInvoice-solutions. Our invoice digitization-software helps you to meet all legal requirements for electronic invoicing and digital invoices to fulfill.

Digital solutions to meet the requirements

With our modern invoicing software you can seamlessly switch from paper invoices to invoice management with e-invoices. Our solution ensures the invoice processing in accordance with the legal requirements and enables you to efficiently and safely electronic invoicing.

Support with the changeover

At DATUREX, we support you throughout the entire process of switching to digital invoices. Our experienced team will advise you individually, implement the right invoicing software and trains your employees in the use of the new invoice processing. How to master the transition to electronic invoicing smoothly.

Recent Comments